Looking to protect your travelling companion? With specialist campervan insurance, you can help to keep costs and stress down should an accident, theft, or damage occur to your adventure-ready vehicle.

Within this ultimate guide to campervan insurance in the UK, our team outline why taking out insurance for your camper is essential, what’s covered in a specialist campervan insurance policy (and more importantly, what’s not covered!), as well as how you can choose the right provider and policy for you.

Regardless of whether you’re looking for insurance for a campervan you’ve just purchased, or you want to do your research before buying, we answer some of the most frequently-asked questions here.

Do I need special insurance for a campervan?

Yes, special insurance is required for driving a campervan on public roads in the UK. This is because the type of insurance you take out must be appropriate for the vehicle you drive, and as a campervan is different to a car, you will need to obtain special campervan insurance.

As a result, you cannot drive a campervan on a standard car insurance policy.

Why campervan insurance is essential

Not only is it wise to protect your campervan in the event of an accident, theft, or damage, but it’s also a legal requirement in the UK. At the very least, you should be covered by third-party insurance if you want to drive a campervan on public roads.

However, different types of campervan insurance exist which can provide you with varying levels of coverage. We explore these different types of campervan insurance in more detail below to help you determine which policy may be the most suitable for you.

What type of campervan insurance do I need?

Like car insurance, there are three main types of campervan insurance in the UK – third-party only, third-party, fire and theft, and comprehensive. To help you determine which type of insurance might be right for you, we explain each one in more detail below.

Third-Party Only

The minimum level of campervan insurance, third-party only insurance means cover is only provided for damage or injury to other people, vehicles, and property. Crucially, however, it does not provide cover for your own camper.

Third-Party, Fire and Theft

As the name suggests, this type of campervan insurance provides the holder with third-party cover as well as protection against theft and fire damage. More expensive campervans can be profitable targets for thieves, so it may be worth considering this option over basic policies.

Comprehensive

The highest level of cover you can get for your campervan, comprehensive campervan insurance covers all the above (third-party risks, fire, theft) as well as protecting your campervan against accidental damage and vandalism. In some cases, it can also provide cover if an uninsured driver hits your campervan.

What’s typically covered by a campervan insurance policy?

A campervan insurance policy should always include the minimum level of cover – third-party cover which protects you in the event of damage or injury to other people, vehicles, and property. However, as standard, many campervan insurance policies also provide:

- Personal belongings cover – Up to a certain limit, this type of cover aims to protect the belongings you commonly store in your campervan. This means you’ll be protected if they’re stolen, or damaged in an incident, fire, or flood.

- Awning cover – Most campervan insurance policies will also provide cover for a fixed awning, protecting it against storm and accidental damage.

- Generator cover – Generators can be essential for campervan travellers, especially while off-grid. That’s why generator cover tends to be included with these policies, providing cover for your generator if it’s damaged in an insured incident.

- Windscreen cover – The cost of repairing chips and cracks to your campervan windscreen can also be covered with these specialist insurance policies.

When choosing the most suitable insurer and policy for your campervan needs, it’s important to carefully read the policy and select the required level of cover for you.

How much is campervan insurance in the UK?

So, how much is it to insure a campervan exactly? According to the London-based insurance broker, Howden, insuring a campervan needn’t be expensive. For more basic campervan insurance policies, you could spend as little as £150 to £200 per year.

As of November 2024, the average cost to insure a campervan in the UK is between £300-£400, based on information published by the specialist campervan insurer, Just Kampers Insurance.

However, there are some factors that can increase your policy payments, such as opting for more comprehensive cover, having a poor driving record, or insuring a larger, more powerful camper. In these cases, you may be required to pay significantly more, with some policies costing over £1,000 per annum.

Optional insurance benefits (such as breakdown cover) as well as the make, model, size, mileage, location, modifications, and age of your campervan can also have an impact on the deals that insurance providers are willing to offer you.

Top tips to get the best campervan insurance quote

For the best deals, it’s important to speak to specialist campervan insurers, obtain a range of quotes, and even consider multi-cover policies that combine cover for your car and campervan.

Once you’ve done your research and have all the options in front of you, you can choose the most appropriate option for both your cover requirements and budget.

If you’re still concerned about the price of campervan insurance in the UK, there are some ways that you can encourage insurers to offer cover at a more competitive cost.

This includes investing in security features, properly protecting your camper over the colder months, and choosing a smaller, more common make and model of campervan.

Adding another named driver can also increase the cost of insuring your campervan in the UK, so keeping the cover to just yourself can help to make insurance costs more manageable.

How to choose the right insurance provider

Unsure where to start when it comes to selecting a campervan insurance provider? Our top three tips include:

Using a comparison site

With so many insurance providers and brokers to explore, comparison sites can make choosing the most appropriate company and policy much easier. They allow you to filter your options by price, rating, or level of cover, providing you with a convenient shortlist of suitable options.

Considering campervan insurance specialists

Not all insurance companies will offer specialist campervan cover, so it’s important to contact specialist campervan insurance brokers for access to more exclusive deals and tailored cover.

Exploring customer reviews

As with any company you’re considering purchasing a product or service from, it’s vital that you read their reviews. If an insurance provider is hiding their reviews or isn’t forthcoming about their overall customer experience, this may indicate poor customer satisfaction and issues with their service.

How to insure a campervan

Getting insurance for your campervan is as simple as heading online to a specialist campervan insurance provider or comparison site. They’ll ask you a selection of relevant questions and offer you deals based on the information provided.

If you’re happy with the deals provided, you’ll need to fill out some personal information and agree to the terms and conditions of the policy. These policies tend to last for a year, but can often be easily renewed with your existing provider for continued cover.

Most campervan insurance policies can be paid for annually or in monthly instalments. However, insurance providers typically add interest on monthly payments which means you’ll pay more in total than if you opted for the annual payment option.

What to do in case of a claim

If you’d like to make a claim under your insurance policy following a campervan accident, damage, or injury, it’s important to get in touch with your insurance provider as soon as possible. You can often make a claim over the phone, via email, or by completing an online form.

FAQs about campervan insurance

Is it more expensive to insure a campervan?

Not necessarily. While campervan insurance can be more expensive than straightforward car or van insurance, the amount you pay will depend on a wide range of factors. From the age, mileage, and condition of the camper to your driving record, quotes and premiums can vary significantly based on this information.

How does campervan insurance work?

With campervan insurance, there’s three main levels of cover: third-party only, third-party, fire, and theft, and comprehensive. Comprehensive policies provide the most cover, while third-party policies provide the minimum level of cover legally required to drive your campervan on public UK roads.

The right cover for you will depend on a wide range of factors including your camper, cover requirements, and budget.

Can I drive a campervan on my car insurance?

No, standard car insurance won’t cover the operation of a campervan. Instead, you’ll need to take out a specialist campervan insurance policy.

Does camper insurance cover contents?

Not all campervan insurance policies will provide personal belongings cover, but some will include it as standard. When choosing a policy, it’s important to check the level of cover to ensure it’s suitable for the number and type of belongings you want to protect.

How old do you have to be to insure a campervan?

Many campervan insurance providers will impose age restrictions for their policies, often preventing under 21’s from taking out this type of insurance. However, younger drivers may still be able to obtain coverage with some specialist insurers that don’t have age restrictions.

Insuring Landseer Leisure’s Ford Custom 2.0

With prices starting at £77,900.00 (including VAT) for Landseer Leisure’s Ford Custom 2.0 campervan, we always recommend taking out comprehensive campervan insurance to protect your new, fully kitted-out travelling companion while you’re out on the road.

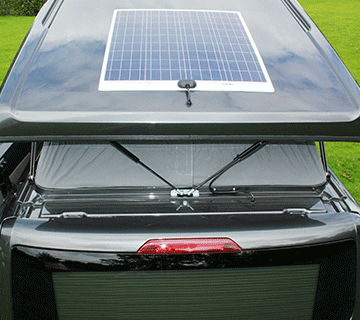

A campervan that’s been specially designed for ultimate luxury living even when you’re off-grid, the Ford Custom 2.0 campervan boasts a wide range of sought-after features and optional extras for additional customisation.

From the brand-new, high-specification Ford Transit Custom Limited chassis to the premium internal finishes (twin induction hobs flush-integrated into a real oak worktop, sensor-activated cabinet lighting, and an improved SCA 324 “pop-top” roof and bed system), this camper offers the highest standards of safety, comfort, and compliance.

Plus, for that special feeling of home while you’re journeying to and exploring new places, you can even customise certain aspects of the camper’s modern interior to suit your taste. This includes both the cabinetry colour as well as the flooring options.

To chat to a friendly member of our team about your campervan preferences or to learn more about the Ford Custom 2.0 campervan at Landseer Leisure, simply contact our helpful team today!

Alongside reaching out online, you can also get in touch by calling 01772 429763 or emailing your enquiry to info@landseerleisure.com.